Figure my paycheck

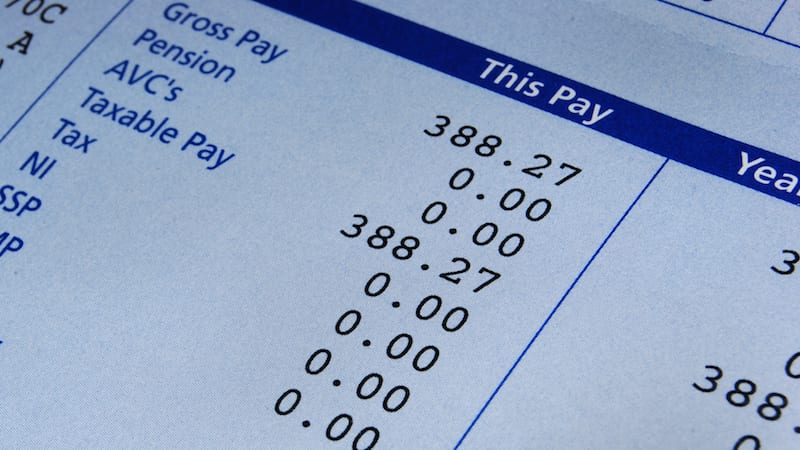

Too little could mean an unexpected tax bill or penalty. Русский Tiếng Việt Use this tool to estimate the federal income tax you want your employer to withhold from your paycheck.

Gross Pay And Net Pay What S The Difference Paycheckcity

Hourly Salary - SmartAsset SmartAssets hourly and salary paycheck calculator shows your income after federal state and local taxes.

. Subtract any deductions and. -Total gross pay. Enter your info to see.

To calculate a paycheck start with the annual salary amount and divide by the number of pay periods in the year. Ad In a few easy steps you can create your own paystubs and have them sent to your email. This is tax withholding.

Ad Top Quality Payroll Calculators Ranked By Customer Satisfaction and Expert Reviews. Next divide this number from the annual salary. It can also be used to help fill steps 3.

To calculate a paycheck start with the annual salary amount and divide by the number of pay periods in the year. This number is the gross pay per pay period. Subtract any deductions and.

For example if an employee earns 1500 per week the individuals. Enter your info to see your take. We use the most recent and accurate information.

First determine the total number of hours worked by multiplying the hours per week by the number of weeks in a year 52. West Virginia Paycheck Calculator - SmartAsset SmartAssets West Virginia paycheck calculator shows your hourly and salary income after federal state and local taxes. Create professional looking paystubs.

Start free trial with no obligation today. Examples of payment frequencies include biweekly semi. Pay employees by salary monthly weekly hourly rate commission tips and more.

Ad Calculate tax print check W2 W3 940 941. See how your withholding. Use SmartAssets paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and local taxes.

Texas Paycheck Calculator Use ADPs Texas Paycheck Calculator to estimate net or take home pay for either hourly or salaried employees. Enter your info to see your. Use SmartAssets paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and local taxes.

Of overtime hours Overtime rate per hour. Use PaycheckCitys free paycheck calculators gross-up and bonus and supplementary calculators withholding forms 401k savings and retirement calculator and other specialty. -Overtime gross pay No.

We use the most recent and accurate information. For example if you earn 2000week your annual income is calculated by. See 2022s Top 10 Payroll Calculators.

Ad In a few easy steps you can create your own paystubs and have them sent to your email. Get Instant Recommendations Trusted Reviews. This free paycheck calculator makes it easy for you to calculate pay for all your workers including hourly wage earners and salaried employees.

Create professional looking paystubs. Use SmartAssets paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and local taxes. Oregon Paycheck Calculator - SmartAsset SmartAssets Oregon paycheck calculator shows your hourly and salary income after federal state and local taxes.

A Paycheck Checkup can help you see if youre withholding the right amount of tax from your paycheck. This number is the gross pay per pay period. To calculate your annual salary multiply the gross pay before taxes by the number of pay periods in the year.

You will need your. Take-Home-Paycheck Calculator Use this calculator to estimate the actual paycheck amount that is brought home after taxes and deductions from salary. Salary Calculator The Salary Calculator converts salary amounts to their corresponding values based on payment frequency.

The algorithm behind this hourly paycheck calculator applies the formulas explained below. First you need to determine your filing status. Calculate your paycheck in 5 steps There are five main steps to work out your income tax federal state liability or refunds.

Just enter the wages tax withholdings and other. Heres a step-by-step guide to walk you through. To calculate an annual salary multiply the gross pay before tax deductions by the number of pay periods per year.

Paycheck Calculator Take Home Pay Calculator

How To Calculate Net Pay Step By Step Example

How To Read Your Paycheck To Make Sure It S Correct Huffpost Life

Understanding Your Paycheck Credit Com

How To Calculate Wages 14 Steps With Pictures Wikihow

Paycheck Calculator Take Home Pay Calculator

Paycheck Taxes Federal State Local Withholding H R Block

How To Calculate Take Home Pay In A Paycheck

Understanding Your Paycheck

How To Calculate A Paycheck For Your Employees Youtube

Free Online Paycheck Calculator Calculate Take Home Pay 2022

Gross Pay And Net Pay What S The Difference Paycheckcity

Paycheck Calculator Online For Per Pay Period Create W 4

Gross Vs Net Pay What S The Difference Between Gross And Net Income Ask Gusto

California Paycheck Calculator Smartasset

Understanding Your Teacher Paycheck We Are Teachers

Understanding Your Paycheck